Creating a budget might seem overwhelming, but it’s one of the most empowering steps you can take toward financial freedom.

With the right mindset and strategies, budgeting can shift from a tedious task to an essential tool for taking charge of your finances and reaching your goals.

In this article, we’ll share 15 practical budgeting tips that will help you save money, track your expenses like a pro, and ultimately pave your way to financial independence.

Product Recommendations:

• Budget planner notebook

• financial calculator

• expense tracking app subscription

1. Set Clear Financial Goals

The journey to effective budgeting starts with a powerful step: defining your vision of financial success. What does it look like for you? Whether you’re dreaming of an unforgettable vacation, eager to conquer debt, or determined to build a solid emergency fund, setting clear, achievable goals gives you a target to aim for.

Break these dreams into bite-sized short-term and long-term objectives. This approach not only clarifies your path but also fuels your motivation, making it easier to stay on track.

Visualize your goals and watch how they transform your budgeting experience. With a well-crafted budget, you can support your lifestyle while steering yourself toward the dreams you cherish.

Product Recommendations:

• Vision board kit

• Goal-setting journal

• Motivational quotes stickers

2. Track Your Income and Expenses

Understanding where your money comes from and where it goes is crucial for effective budgeting. Start by tracking all sources of income, including salary, side gigs, and passive income.

Next, keep a detailed record of your expenses, categorizing them into fixed, variable, and discretionary spending.

This gives you a clear picture of your financial habits and helps identify areas where you can cut back. Armed with this information, you can make informed decisions that align your spending with your goals.

Product Recommendations:

• Expense tracking app subscription

• Budgeting notebook

• Financial management book

3. Create a Realistic Budget Plan

Once you have a clear understanding of your income and expenses, it’s time to create a budget plan that works for you.

Choose a budgeting method that suits your lifestyle—whether it’s the 50/30/20 rule, zero-based budgeting, or the envelope system.

Make sure your budget is realistic and flexible enough to accommodate unexpected expenses. A well-structured budget not only helps you manage your money better but also reduces financial stress.

Product Recommendations:

• Monthly budget planner

• Sticker set for planners

• Desk organizer

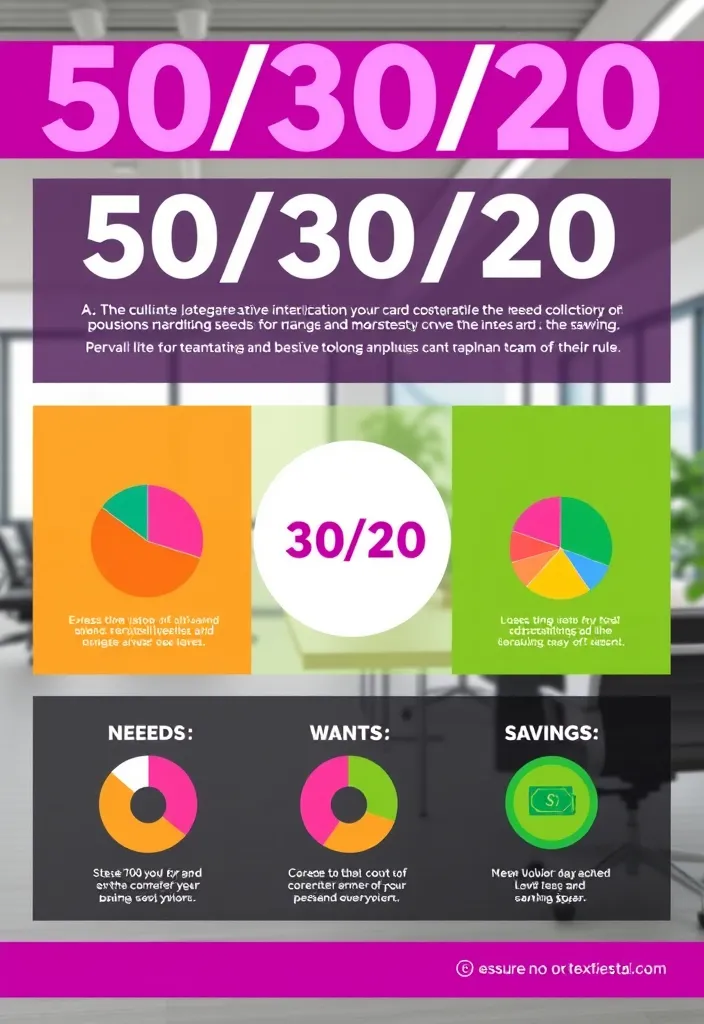

4. Use the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting strategy that divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

This simple framework helps you prioritize essential expenses while still allowing for discretionary spending.

By adhering to this rule, you can maintain a balanced approach to budgeting that fosters both financial responsibility and personal fulfillment.

Product Recommendations:

• Infographic design software

• Budgeting course

• Personal finance book

5. Automate Savings

One of the easiest ways to ensure you save consistently is to automate your savings. Set up automatic transfers from your checking account to a savings account each month.

This ‘pay yourself first’ strategy makes saving a priority rather than an afterthought, helping you build your emergency fund or save for specific goals without extra effort.

Over time, you’ll be surprised at how quickly your savings grow.

Product Recommendations:

• Savings account

• Personal finance workshop

6. Review and Adjust Regularly

A budget is not a one-time task; it requires regular reviews and adjustments to stay effective. At the end of each month, assess your spending and compare it to your budget.

Identify areas where you went over or under budget, and adjust your categories accordingly for the next month.

This practice not only helps you stay accountable but also strengthens your understanding of your financial habits and needs.

Product Recommendations:

• Monthly budget review checklist

• Laptop stand

• Cozy desk lamp

7. Cut Unnecessary Expenses

Analyzing your expenses may reveal areas where you can cut back without sacrificing your quality of life. Look for subscriptions you rarely use, dining out habits, or impulse purchases that can be minimized.

By identifying and eliminating unnecessary expenses, you can redirect those funds towards savings or debt repayment, allowing you to achieve your financial goals faster.

Remember, small changes can lead to significant savings over time.

Product Recommendations:

• Expense tracker template

• Subscription management app

• Budgeting calculator

8. Use Cash for Discretionary Spending

Switching to cash for discretionary spending can help you stick to your budget more effectively. By withdrawing a set amount of cash for categories like entertainment or dining out, you can visually track your spending and resist the temptation to overspend.

Once the cash is gone, you know it’s time to stop spending in that category for the month.

This cash-only approach can instill a greater sense of awareness and discipline in your spending habits.

Product Recommendations:

• Stylish wallet

• Cash envelope system

• Spending tracker app

9. Plan for Irregular Expenses

Many people forget to budget for irregular expenses that pop up throughout the year, such as car maintenance, insurance payments, or holiday gifts.

Create a separate category in your budget for these irregular expenses, and consider setting aside a small amount each month to cover them when they arise.

By planning ahead, you can avoid financial stress and ensure that you’re prepared for these unexpected costs.

Product Recommendations:

• Expense binder

• Budgeting app for irregular expenses

• Financial planning book

10. Seek Discounts and Coupons

Incorporating discounts and coupons into your shopping routine is an effective way to save money. Look for promotional offers, use cashback apps, and join loyalty programs to maximize your savings.

Being mindful of potential savings can significantly reduce your overall expenses, allowing you to allocate more funds towards your financial goals.

Moreover, it can turn shopping into a fun and strategic activity rather than a burden.

Product Recommendations:

• Cashback apps subscription

• Coupon organizer

• Shopping planner

11. Create an Emergency Fund

Establishing an emergency fund is a crucial aspect of budgeting that provides a financial safety net for unexpected expenses. Aim to save at least three to six months’ worth of living expenses in a separate savings account.

This fund can help you avoid going into debt when facing emergencies, such as medical bills or car repairs.

Knowing you have a cushion can also provide peace of mind and allow you to focus on achieving your other financial goals.

Product Recommendations:

• Piggy bank

• High-yield savings account

• Emergency fund planner

12. Educate Yourself on Personal Finance

Investing time in personal finance education can empower you to make informed decisions about budgeting and spending. Read books, listen to podcasts, or attend workshops to expand your financial knowledge.

The more you understand about money management, the more confident you’ll be in your budgeting choices.

This education can provide you with valuable tools and strategies to navigate your financial journey successfully.

Product Recommendations:

• Personal finance books

• Online financial courses

• Podcast subscription

13. Involve Your Family

Budgeting shouldn’t be a solo activity, especially if you have a family. Involve your family members in the budgeting process to encourage teamwork and accountability.

Discuss financial goals together, set spending limits for shared expenses, and celebrate achievements as a unit.

This collaborative approach fosters open communication about money and helps everyone understand the importance of budgeting.

Product Recommendations:

• Family budgeting planner

• Discussion cards for money talks

• Financial goal-setting workbook

14. Celebrate Small Wins

Budgeting can sometimes feel overwhelming, so it’s important to celebrate your small wins along the way. Whether it’s reaching a savings milestone, paying off a debt, or sticking to your budget for a month, acknowledge these achievements.

Celebrating small victories boosts motivation and reinforces positive financial behaviors, making budgeting a more enjoyable process.

Create rituals or rewards for yourself to keep the momentum going.

Product Recommendations:

• Celebration planner

• Motivational wall art

• Fun reward ideas book

15. Stay Committed and Patient

Finally, commitment and patience are key to successful budgeting. Financial changes take time, and there will be ups and downs along the way.

Stay focused on your goals, and don’t be discouraged by setbacks. Remind yourself that budgeting is a journey towards financial freedom, not a sprint.

With dedication and perseverance, you’ll start to see the fruits of your labor and enjoy the benefits of financial stability.

Product Recommendations:

• Motivational wall art

• Personal journal

• Commitment planner

Conclusion

Creating a budget that works for you is a vital step towards achieving financial freedom.

By implementing these 15 budgeting tips, you can take control of your finances, save money, and pave the way for a more secure future.

Remember, the journey may not always be easy, but with commitment and the right strategies, you can reach your financial goals.

Note: We aim to provide accurate product links, but some may occasionally expire or become unavailable. If this happens, please search directly on Amazon for the product or a suitable alternative.

Leave a Reply